2022 Tax Refunds and Personal Bankruptcy

5 Do’s and 5 Don’ts If you are considering filing for personal bankruptcy relief, be sure to read these helpful tips before spending your 2022

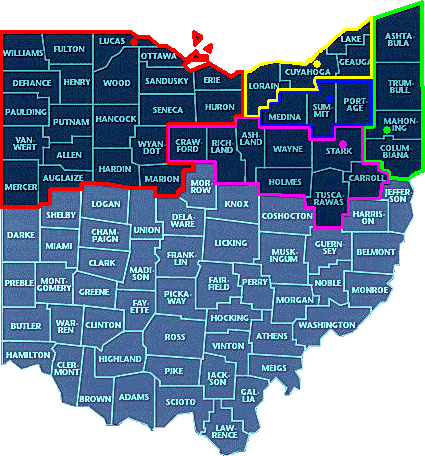

Our service area extends throughout most of Northwest Ohio and Southeast Michigan including the following cities: Toledo, Findlay, Sandusky, Swanton, Monroe and more.

We strive to provide exceptional client service and to use our wealth of Toledo, Ohio, bankruptcy law experience to serve and protect our clients from creditors. With over 13 years of bankruptcy law experience, bankruptcy lawyer Scott France offers the perfect balance between experience and price. Having a prepared Toledo bankruptcy lawyer who is familiar with your bankruptcy case has many client benefits. Your fresh start begins here.

France Law Group includes Toledo Attorneys trained in

Ohio Bankruptcy Law

Are you overwhelmed by nonstop letters and phone calls from creditors and debt collectors? Are you a veteran or in the military? Are your wages being jeopardized with garnishment? Is your home in danger of foreclosure? Are you in danger of losing your car or other vehicle? And lastly, are you wondering about the cost of filing for bankruptcy?

If plagued with one or more of the preceding financial problems and you need answers to the preceding questions, it may be time to speak with a knowledgeable Toledo, Ohio, bankruptcy attorney to seek financial relief and protection. If you are considering filing bankruptcy, France Law Group will answer your questions and help you make well-informed decisions. No matter your financial situation, you have legal options available.

A native of Bowling Green, Ohio, Scott graduated from Bowling Green High School in 1986 and currently resides in Toledo, Ohio. Scott is frequently asked to serve as an Adjunct Professor at local community colleges, including Owens Community College. Scott’s collegiate teaching portfolio includes Toledo, Ohio, Bankruptcy Law, Criminal Law, Legal Environment for Business, Entrepreneurship, Introduction to Business, Business/Leadership, and Medical Law/Ethics.

Those closest to Scott know that he is a former teaching tennis professional and he also was an elementary school Physical Education teacher for 6 years (Little Flower School & St. Joan of Arc School, both in Toledo, Ohio) before entering the practice of law. Outside of his professional life, Scott holds a black belt in karate, enjoys competitive tennis, and is an avid fan of the Boston Red Sox, Indianapolis Colts, and University of Toledo athletics.

Are you overwhelmed by nonstop letters and phone calls from creditors and debt collectors? Are you a veteran or in the military? Are your wages being jeopardized with garnishment? Is your home in danger of foreclosure? Are you in danger of losing your car or other vehicle? And lastly, are you wondering about the cost of filing for bankruptcy?

If plagued with one or more of the preceding financial problems and you need answers to the preceding questions, it may be time to speak with a knowledgeable Toledo, Ohio, bankruptcy attorney to seek financial relief and protection. If you are considering filing bankruptcy, France Law Group will answer your questions and help you make well-informed decisions. No matter your financial situation, you have legal options available.

When you contact the France Law Group, one of Toledo’s most experienced groups of bankruptcy lawyers, they will work vigorously to help you discover the most effective resolutions to your financial problems. Since there are several chapters under the Toledo, Ohio, Bankruptcy Code that a client can file, the France Law Group attorneys will help you decide which chapter is the best for you.

Furthermore, our skilled legal team will help you explore options of NOT filing for bankruptcy. Should you or a family member consider bankruptcy protection in Ohio, please contact our Toledo law office today for a no obligation, free, initial consultation.

Call Us Today

Understanding the Basics of Chapter 7 Bankruptcy

Chapter 7 Bankruptcy is known as “complete” or “liquidation” bankruptcy. It is the most common type of bankruptcy filing. Chapter 7 Bankruptcy in Toledo will remove many debts such as medical, credit card and other kinds of debt. The Chapter 7 Bankruptcy process will include an intake interview, listing the client’s income and assets. and outstanding debts.

One common belief is that individuals filing for Chapter 7 Bankruptcy will lose all their assets. However, utilizing the application of “exemptions” coupled with the assistance of a skilled and knowledgeable bankruptcy lawyer, you will be able to keep all or most of your assets.

Throughout the Bankruptcy procedure, you will be required to attend a meeting with your creditors, also known as the 341 meeting. Normally, a Chapter 7 Bankruptcy will last between four and six months before the Toledo, Ohio, bankruptcy is discharged.

Call Us Today

Don’t lose your vehicle in bankruptcy.

Not everyone is qualified to file for Chapter 7 bankruptcy. The Courts in the United States affirm that Chapter 7 bankruptcy petitioners must meet a “Means Test,” which will assess the last six months of the petitioner’s gross income. If the bankruptcy petitioner’s gross income is higher than the average monthly income in the petitioner’s state based on an adjusted household size, the petitioner may likely be ineligible for Chapter 7 bankruptcy relief and protection. Another consideration is if the petitioner’s monthly income is below median, the bankruptcy petitioner may satisfy the “Means Test”. However, a more extensive assessment of the petitioner’s financial situation may be required.

Chapter 7 bankruptcy protection offers numerous essential benefits to financially distraught debtors. Primarily, having your bankruptcy attorney file a Chapter 7 bankruptcy petition will stop phone calls and collection letters. Chapter 7 bankruptcy is a sensible remedy especially if you are deeply in debt. Declaring Chapter 7 bankruptcy gives you the opportunity to discharge many of your debts and allows you a chance to get a fresh start. Lastly, and of great importance, is the fact that declaring a Chapter 7 bankruptcy will allow you generous asset protection.

Drawbacks of a Toledo, Ohio, Bankruptcy

As with many financial matters, there are considerable downsides when you declared a Chapter 7 bankruptcy. For instance, when filing for a Chapter 7 bankruptcy your credit rating will be negatively affected. Additionally, some clients may unintentionally expose certain assets. Unfortunately, a Chapter 7 bankruptcy will not focus on particular kinds of debt that other bankruptcy chapters do. Your Toledo, Ohio bankruptcy attorney will assist you as you assess and identify the possible downsides when compared with your other options.

Don’t lose your business in bankruptcy.

Understanding the Basics

Chapter 13 bankruptcy is most notably known as a “restructuring” or “reorganization” bankruptcy. Chapter 13 Bankruptcy is geared toward people needing to bring their mortgages current and for people with tax or domestic support obligations. Chapter 13 Bankruptcy also pertains to people who want to settle a variety of unsecured debt or individuals not qualifying for Chapter 7 Bankruptcy relief under the “Means Test.”

A Chapter 13 Bankruptcy may also stop foreclosures, allow you to clear up defaulted mortgage payments, lower car loan interest rates, and allow individuals to repay tax debt without penalties and fees. The normal time a Chapter 13 Toledo, Ohio Bankruptcy will last is 3-5 years. The process includes making a monthly payment to the Trustee with the Trustee dispensing payments to the individual creditors. Also, the individuals may wish to include a portion of attorney fees in the monthly plan payments.

Eligibility for Chapter 13 Bankrupt in Toledo, Ohio?

Since it is less difficult to qualify for a Chapter 13 Bankruptcy than for a Chapter 7 Bankruptcy, there are a few conditions that must be followed. Of utmost importance is the condition that Chapter 13 Bankruptcy petitioners must be current with taxes. For example, the individuals must have filed all taxes, otherwise the petition for Chapter 13 Bankruptcy will not go forward.

Bottomline, all tax problems must FIRST be resolved. Moreover, there are various debt limitations that must be considered. Lastly, it is imperative that the individual have adequate disposable income to generate a feasible restructuring plan because United States Bankruptcy Courts will not accept a repayment plan that is certain to fail. Whereas, in a Chapter 7 Bankruptcy “Means Test” that determines eligibility, in a Chapter 13 Bankruptcy, the “Means Test” pertains to the length of the plan and how much, if anything, will be paid to unsecured creditors.

Call Us Today

Filing for Chapter 13 Bankruptcy Instead of Chapter 7 in Toledo, Ohio?

Chapter 13 Bankruptcy is a powerful instrument that allows petitioners to bring house payments up to date versus foreclosing on their home. Chapter 13 Bankruptcy is also a tool that allows a petitioner to repay a tax debt or get current on child or spousal support. However, people do file for a Chapter 13 Bankruptcy because they are ineligible for a Chapter 7 Bankruptcy. In those cases, it may be the best option available.

For many financially distraught borrowers, Chapter 13 Bankruptcy protection is the better choice. For instance, if petitioners are given more time and/or different terms, it may be prudent for petitioners to repay a major portion of their debts. Chapter 13 Bankruptcy may work well for distraught borrowers who own nonexempt real estate that they wish to retain.

How long do points stay on your Ohio drivers license?

Each set of points remains on the penalized driver’s Ohio BMV record for 2 years. Depending on the specific traffic citation, points typically range from 0 to 6 per offense. An accumulation of 12 points on your Ohio driver’s license will result in a suspension.

What are some examples of 2 point traffic violations in Toledo, Ohio?

Railroad crossing violations, prohibited U-Turns, most speeding citations, failure to obey a traffic sign or signal, marked lanes, following too closely, failure to yield to an emergency vehicle, failure to yield to a pedestrian, stopped school bus violation, following too closely, and failure to maintain an assured clear distance.

What are some examples of 4 point traffic violations in Toledo, Ohio?

Reckless operation, speeding in excess of 30 mph over the legal limit, and speeding in a commercial vehicle

What are some examples of 6 point traffic violations in Toledo, Ohio?

Driving with a suspended license, drag racing, vehicular homicide, fleeing an accident scene, and operating a vehicle while intoxicated (OVI).

Call Us Today

Short answer: sometimes. In certain circumstances, bankruptcy attorneys may choose to take payment plans for their legal services. However, these circumstances are limited and should be discussed with your bankruptcy attorney. Chapter 13 bankruptcies are the most common example of making payments on bankruptcy attorney fees. In Chapter 13 bankruptcy cases a portion of one’s attorney fees are repaid as part of a 36 to 60 month debt repayment plan. About 12% of all bankruptcy filings near Toledo, Ohio are Chapter 13 bankruptcies.

Simple answer: In most cases, yes you can keep your house in bankruptcy. There are some exceptions which we will discuss further. Under Ohio bankruptcy law, a debtor can protect $145,425 of equity in her home. This exemption can double if you are filing a joint chapter 7 bankruptcy and both debtors are on the deed. For example, a single debtor files chapter 7 bankruptcy. Let’s say her home is worth $250,000. Her mortgage balance is $150,000. This leaves $100,000 of home equity. By applying the Ohio homestead exemption, there is more than enough protection ($145,425) to protect the equity in this home. As an alternative, those debtors involved in a chapter 13 bankruptcy repayment plan do not face the risk of losing their home so long as they are making their timely payments. Finally, it is important to note the importance of staying current on one’s mortgage payments. Regardless of bankruptcy, one can lose his or her home via foreclosure if the mortgage payments are not timely made to the mortgage company.

Simple answer: Most bankruptcy debtors are able to keep their vehicles after filing bankruptcy. There are some exceptions which we will discuss further. Under Ohio bankruptcy law, a debtor can protect up to $4,450 of equity in his or her primary vehicle. A debtor must be on the vehicle title to use this Ohio motor vehicle exemption. For example, a single debtor files chapter 7 bankruptcy in Ohio. His vehicle is worth $20,000. The outstanding loan balance on the vehicle is $18,000, leaving $2,000 in exposed vehicle equity. By applying the Ohio motor vehicle bankruptcy exemption of $4,450, the protection is more than enough to protect the vehicle’s equity. If needed, a joint debtor who is also on the same vehicle title can also apply an additional $4,450 in bankruptcy equity protection. Alternatively, in chapter 13 bankruptcy, a vehicle is not at risk as the debtor continues to make monthly vehicle payments, typically via the Bankruptcy Court. Regardless of bankruptcy, one can lose his or her vehicle by repossession if timely payments are not made to the loan company.

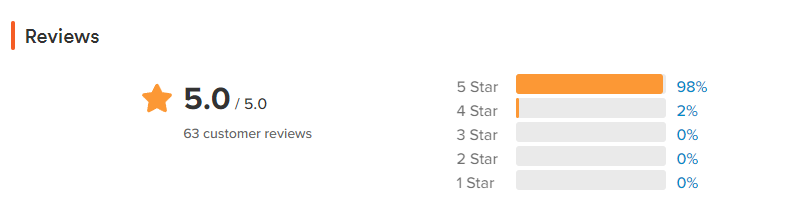

Everyone has a distant relative who is best friends with a bankruptcy attorney, right? There’s a safer and better way to choose a Toledo bankruptcy attorney that is right for you. Choosing the right Toledo bankruptcy attorney is important to the success of your case. Since the attorney/client relationship may last from months to years in bankruptcy matters, it is important to choose a Toledo bankruptcy attorney that you are comfortable with. We suggest finding a bankruptcy attorney who has these attributes: Experience (10+ years); Price (middle range, but not overpriced); Personality (easy to get along with); and demonstrated client success (client review).

While there may be a few documents that are unique to your bankruptcy, here is a basic list of required documents needed before filing for bankruptcy relief: 2 years tax returns (federal and state); 6 months of paystubs; 6 months of bank statements; copy of vehicle registration or title; list of creditors (loose bills and credit report); and a credit counseling certificate.

Yes, as a bankruptcy debtor you can file alone or with a spouse. The choice is yours, however we suggest that you first have a discussion with your bankruptcy attorney about whether or not to include your spouse in a bankruptcy. Sometimes, the experienced bankruptcy attorney may offer insight that will help maximize the fresh start in your home. There is no extra charge to add a spouse to your initial bankruptcy filing.

By working closely with your bankruptcy attorney, it is possible to remove the fear and anxiety of going to Court. Your Chapter 7 bankruptcy attorney will take the time to discuss what will happen at the Meeting of Creditors as well as any other hearing that may arise during your case. The most common Chapter 7 bankruptcy hearing is the Meeting of Creditors. Typically, this hearing is held about 7 weeks post filing and your bankruptcy attorney will sit beside you. The Meeting of Creditors is an opportunity for the Bankruptcy Trustee to ask you some basic questions about your income, assets, and liabilities so that they may properly administer your bankruptcy estate. An average length for the Chapter 7 Meeting of Creditors is 6-12 minutes. At France Law Group, we stand with our clients and work hard to ease any anxieties about attending Court.

About 88% of all bankruptcy filings in Toledo, Ohio are Chapter 7 bankruptcies. This type of bankruptcy is often referred to as liquidation. We encourage all clients to have a discussion with our bankruptcy attorney about asset values, with a focus on whether or not a particular asset has excessive equity beyond the protections offered by law (“exemptions”). Under current bankruptcy laws, it is becoming less common for a debtor to lose their home or primary vehicle.

Every bankruptcy case requires two credit counseling certificates, one prior to filing and a second about 2 months after filing your bankruptcy. There is no need to leave your home and attend boring lectures. Most credit counseling certificates can be earned via online courses, costing about $15.00 per course. Some course providers also offer telephonic course options. The online courses take about 60-90 minutes. Upon successful course completion, your Court approved course provider will email a copy of your certificate to your bankruptcy attorney.

At France Law Group, we pride ourselves on being honest and helpful to all of our clients. Sometimes that means we suggest non-bankruptcy alternatives, including referrals to outside resources when appropriate. Individual creditor negotiations may be appropriate in situations where a debtor has a small number of creditors and simply needs help negotiating a reasonable payment plan.

Chapter 7 bankruptcy eliminates most unsecured debts and provides debtors with a fresh start. Examples of these unsecured debts include, medical bills, auto repossessions, credit card debt, and older payday loans. U.S. Congress enacted Chapter 7 bankruptcy to help individuals burdened by debt to obtain a “fresh start” and begin rebuilding their lives. Chapter 7 bankruptcy is referred to as “liquidation” because some debtors may have to surrender some of their assets in exchange for the elimination of most debts. Surrendering assets is becoming less common in recent years as the bankruptcy exemptions have continued to improve. Most people are able to keep their homes, cars, and various other personal assets. Be sure to discuss any such concerns with your Toledo bankruptcy attorney. Having an experienced Toledo Chapter 7 bankruptcy attorney on your side can make all the difference.

Before the COVID-19 pandemic, it was estimated that nearly 4,000 Northwest Ohioans will file for Chapter 7 bankruptcy relief in 2022. That number is expected to rise sharply as the COVID-19 pandemic runs its course in Ohio. Chapter 7 bankruptcy filings in the metro Toledo, Ohio area account for about 85% of all bankruptcy filings. Chances are that you know someone who received a Chapter 7 discharge and now has their “fresh start”. Over the years, our local bankruptcy attorneys have helped Ohio debtors from all walks of life, including doctors, factory workers, retailers, skilled laborers, attorneys, hair stylists, teachers, retirees, unemployed, disabled, military veterans, and many more. Chapter 7 bankruptcy provides relief from mounting debts that cannot be repaid. There is no real link between one’s age and bankruptcy filings. Our clients come to us for help eliminating debts from credit cards, medical bills, utility arrears, vehicle repossessions, collection attempts, payday loans, and more. Chapter 7 bankruptcy also stops most collection lawsuits that can lead to a wage garnishment if not resolved quickly. During your free initial bankruptcy consultation, your local bankruptcy attorney will get to know your situation and advise you as to whether Chapter 7 bankruptcy is right for you.

Under current bankruptcy laws, a debtor who has received a Chapter 7 bankruptcy discharge must wait eight (8) years to file again. The eight (8) year waiting period begins on the date of filing your previous Chapter 7 bankruptcy. If you have previously filed a Chapter 7 bankruptcy, then be sure to ask your local bankruptcy attorney to find your filing anniversary date. Those who file a second Chapter 7 bankruptcy too soon, risk dismissal. If you cannot wait until your eight (8) year filing anniversary, then consult your local bankruptcy attorney about your Chapter 13 bankruptcy alternative.

Yes, the filing of bankruptcy stops most wage garnishments. If your wages are being garnished be sure to consult a Toledo, Ohio bankruptcy attorney for help.

There are some types of unsecured debts that are not dischargeable in Chapter 7 bankruptcy.. Be sure to ask your Toledo Chapter 7 bankruptcy attorney whether you have any nondischargeable debts. If a debt is not discharged, it simply means that you will continue to owe that particular debt post bankruptcy. Some common examples of nondischargeable debts in a Chapter 7 bankruptcy are child support arrears, income taxes, student loans, court fines, criminal restitution, government benefit overpayments, some types of recent credit use, and post petition debts.

Chapter 13 bankruptcy is a debt repayment plan lasting 36-60 months. During the repayment period, debtors are protected from their creditors while making one monthly payment to the Chapter 13 Trustee. The amount of said repayment will depend on variables such as household income and the types and amounts of consumer debts.

Chapter 13 is common for debtors with regular income who either don’t qualify for Chapter 7 bankruptcy relief. Chapter 13 bankruptcy is a prudent alternative to debt consolidation programs and offers stronger Court protections to the debtor while they successfully complete their repayment plan. Chapter 13 bankruptcy is also a solid option for those facing threats of home foreclosure or wage garnishment.

Yes. Student loans can be a part of your repayment plan within a Chapter 13 bankruptcy. While your local bankruptcy attorney will devise a specific repayment strategy, the general rule is that a debtor should treat both unsecured debts and student loans similarly. For debtors with large student loan balances, it is likely that you will make progress on your student loans in Chapter 13 bankruptcy, however repayment of the unpaid portion of your student loans will continue post bankruptcy.

Yes. You will be obligated to include any unpaid income taxes within your Chapter 13 bankruptcy repayment plan. Income taxes are generally considered a priority debt, meaning that they must be 100% repaid during the 36-60 month repayment plan period.

Mortgage payment arrears can be placed inside the Chapter 13 repayment plan. Generally a “conduit” is created, meaning that during the Chapter 13 bankruptcy you will make your mortgage payments directly to the Chapter 13 Trustee as well payment on your other debts, including mortgage arrears. In other words, one consolidated payment which includes your mortgage, your mortgage arrears, your credit cards, and similar debts. At the end of the repayment plan, the mortgage balance will remain and the debtor will pick up those payments.

No. Unlike its Chapter 7 counterpart, in Chapter 13 bankruptcy there is no liquidation risk. Our clients move forward with confidence knowing that they are protecting their property while paying down their debts.

Once your Chapter 13 bankruptcy case is filed, your first payment to the Trustee must be made within 30 days. Payments continue monthly thereafter and the amount of each payment will likely adjust to meet the debtor’s actual debts.

5 Do’s and 5 Don’ts If you are considering filing for personal bankruptcy relief, be sure to read these helpful tips before spending your 2022

The Differences Between Bankruptcies: Chapters 7, 11, and 13 Recently, I met a prospective client with over $30,000.00 in medical debt. She lives with her

Chapter 7 bankruptcy is an excellent tool for wiping out debt, especially when it comes to credit cards and medical debt. But who exactly are

We are a debt relief agency.

We help people file for relief under the United States Bankruptcy Code.

Bankruptcy Lawyer Scott France

6545 W. Central Avenue

Suite 203

Toledo, OH 43617

Phone: (419) 725-9300

Fax: (419) 865-1344

Office Hours:

Mon.-Fri. 9am-10pm

Sat. and Sun. 11am-10pm

Evening office meetings available

Debt Relief:

Your fresh start begins here.